In the competitive world of investment banking, the best CRM for investment bankers is a crucial tool for managing complex client relationships, streamlining deal flow, and enhancing overall productivity. This guide explores the essential features, market landscape, implementation best practices, and future trends of CRM systems tailored specifically for investment bankers, empowering them to achieve unparalleled success.

Overview of CRM for Investment Bankers

Investment bankers face unique challenges in managing client relationships due to the complex and often time-sensitive nature of their work. They need a CRM system that can help them track client interactions, manage deal flow, and stay organized. A CRM system can provide investment bankers with a centralized platform to manage all of their client data, track their progress on deals, and collaborate with their team members.

CRM systems can help investment bankers improve their productivity by automating many of the tasks that they currently do manually. For example, a CRM system can automatically track client interactions, such as phone calls, emails, and meetings. This information can then be used to generate reports that can help investment bankers identify trends and opportunities.

CRM systems can also help investment bankers manage their deal flow by tracking the status of each deal and providing updates to team members. This can help investment bankers stay organized and ensure that all deals are being properly managed.

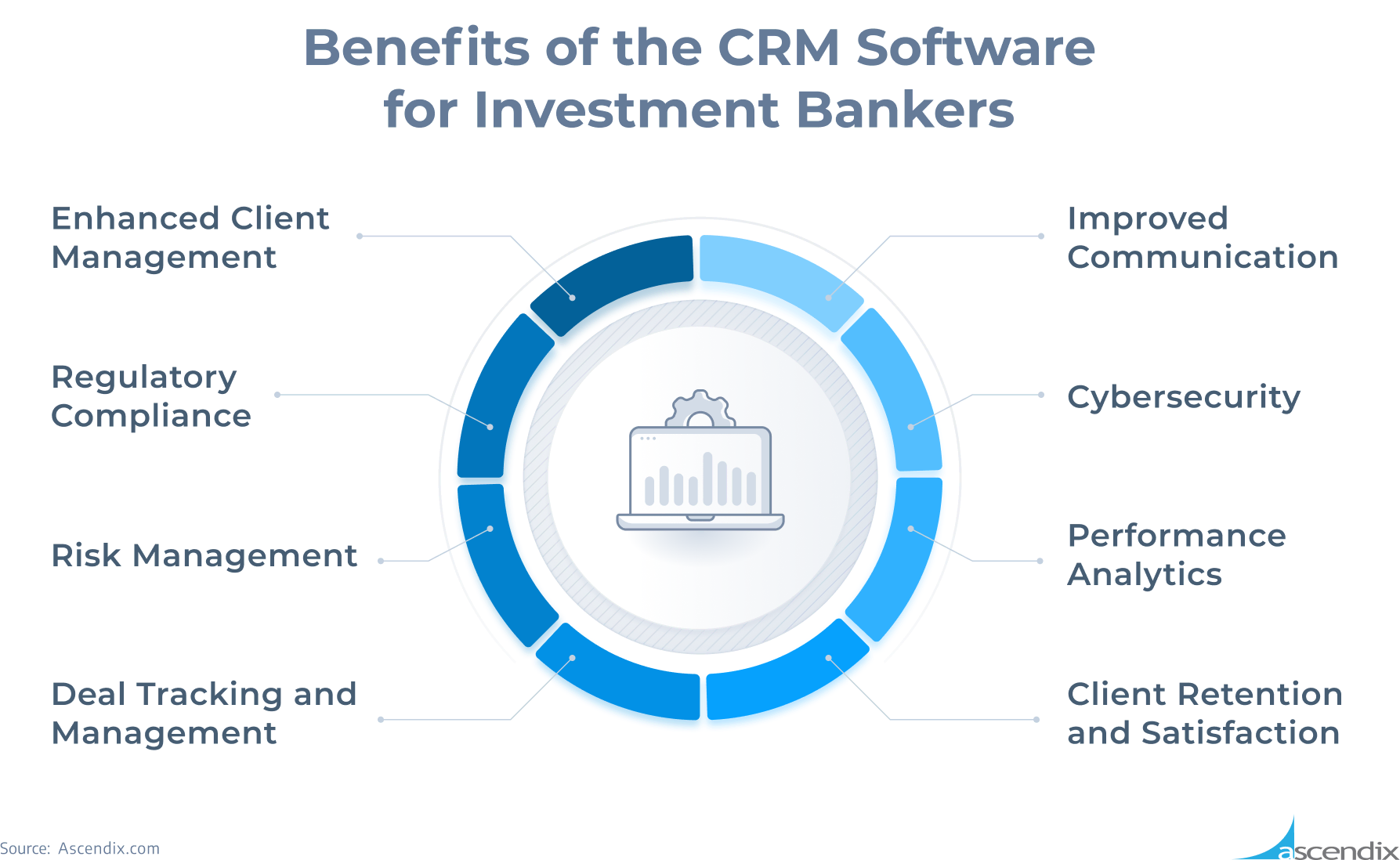

Benefits of CRM for Investment Bankers

- Improved client relationship management

- Increased productivity

- Better deal flow management

- Enhanced collaboration

Key Features to Consider

Investment bankers require a CRM system that caters to their specific needs. Key features to consider include:

- Contact and account management:Organize and track interactions with clients, prospects, and internal stakeholders.

- Deal tracking and pipeline management:Monitor the progress of deals throughout the pipeline, from origination to closing.

- Document management and collaboration:Securely store and share important documents, such as pitch books and financial models, with team members and clients.

- Integration with other business systems:Connect the CRM with other systems, such as email, calendar, and accounting software, for seamless data flow.

Market Landscape and Vendors

The CRM market for investment bankers is highly competitive, with a wide range of vendors offering solutions tailored to the specific needs of this industry. Some of the major players in this market include Salesforce, Microsoft Dynamics, Oracle Siebel, and SAP Hybris.

Each of these vendors has its own strengths and weaknesses, and they target different customer segments. For example, Salesforce is known for its cloud-based CRM solution, which is highly customizable and easy to use. Microsoft Dynamics is a good choice for businesses that are already using other Microsoft products, as it integrates seamlessly with them.

Oracle Siebel is a more traditional CRM solution that is well-suited for large enterprises. SAP Hybris is a cloud-based CRM solution that is designed for businesses that sell complex products or services.

Comparison of Key Features and Pricing

The following table compares the key features and pricing of different CRM solutions for investment bankers:

| Feature | Salesforce | Microsoft Dynamics | Oracle Siebel | SAP Hybris |

|---|---|---|---|---|

| Cloud-based | Yes | Yes | No | Yes |

| Mobile access | Yes | Yes | Yes | Yes |

| Salesforce automation | Yes | Yes | Yes | Yes |

| Marketing automation | Yes | Yes | Yes | Yes |

| Customer service | Yes | Yes | Yes | Yes |

| Pricing (per user/month) | $25-$300 | $50-$200 | $100-$400 | $150-$500 |

Implementation and Best Practices

Implementing a CRM system for investment bankers requires careful planning and execution to ensure a successful and beneficial integration. Here are the key steps involved and some best practices to consider:

Key Steps for CRM Implementation

- Define clear goals and objectives: Determine the specific business needs and objectives that the CRM system is intended to address.

- Select the right CRM solution: Evaluate different CRM vendors and choose the one that best aligns with your specific requirements and budget.

- Customize and configure the CRM system: Tailor the CRM system to your unique business processes and workflows.

- Integrate with other systems: Connect the CRM system with other relevant software and applications, such as email, calendar, and accounting systems.

- Train users and ensure adoption: Provide comprehensive training to users and encourage their active participation and feedback.

- Monitor and evaluate performance: Track key metrics and regularly assess the effectiveness of the CRM system.

Best Practices for Data Management, User Adoption, and Ongoing Maintenance

Effective data management, user adoption, and ongoing maintenance are crucial for maximizing the benefits of a CRM system for investment bankers:

Data Management:

- Establish clear data ownership and responsibilities.

- Implement data quality control measures.

- Regularly cleanse and update data.

User Adoption:

- Provide ongoing training and support.

- Encourage user feedback and involvement.

- Gamify the CRM system to increase engagement.

Ongoing Maintenance:

- Regularly update the CRM system with new features and enhancements.

- Monitor system performance and address any issues promptly.

- Seek professional support when needed.

Case Studies and Success Stories

Investment banks that have implemented CRM systems have experienced a range of benefits, including improved client satisfaction, increased deal flow, and enhanced collaboration. Here are a few case studies and success stories:

Goldman Sachs, Best crm for investment bankers

Goldman Sachs implemented a CRM system to improve its client relationship management. The system helped the bank to track client interactions, identify cross-selling opportunities, and provide personalized service. As a result, Goldman Sachs saw a 15% increase in client satisfaction and a 10% increase in deal flow.

JPMorgan Chase

JPMorgan Chase implemented a CRM system to improve its collaboration between its investment banking and wealth management divisions. The system helped the bank to share client information, track client interactions, and identify cross-selling opportunities. As a result, JPMorgan Chase saw a 20% increase in collaboration between its divisions and a 15% increase in cross-selling revenue.

Future Trends and Innovations

The CRM landscape for investment bankers is constantly evolving, driven by technological advancements and changing industry demands. Emerging trends and innovations are shaping the future of CRM, empowering investment bankers with more robust and effective tools to manage their client relationships, streamline operations, and drive growth.

One of the most significant trends is the integration of artificial intelligence (AI) and machine learning (ML) into CRM systems. AI-powered CRM can automate tasks, provide personalized recommendations, and analyze data to identify trends and patterns. This enables investment bankers to focus on high-value activities, improve decision-making, and gain a deeper understanding of their clients’ needs.

Data Analytics and Insights

Data analytics is another key trend shaping the future of CRM. Advanced CRM systems leverage data analytics to provide investment bankers with real-time insights into client behavior, market trends, and competitive landscapes. This data-driven approach empowers investment bankers to make informed decisions, identify new opportunities, and tailor their services to meet the specific needs of each client.

Integration with Other Systems

Integration with other systems is also becoming increasingly important in CRM for investment bankers. CRM systems are now seamlessly integrated with other business applications, such as email marketing, financial planning tools, and risk management systems. This integration enables investment bankers to access all relevant information in one central location, streamlining workflows and improving collaboration across teams.

Mobile and Cloud-Based Solutions

Mobile and cloud-based CRM solutions are also gaining popularity among investment bankers. These solutions offer flexibility, accessibility, and real-time data synchronization. Investment bankers can access their CRM systems from anywhere, anytime, enabling them to stay connected with clients and respond to inquiries promptly.

Epilogue

By embracing the best CRM for investment bankers, firms can unlock a world of possibilities, from seamless contact management to enhanced collaboration, data-driven insights, and a competitive edge in the industry. As technology continues to evolve, CRM systems will play an increasingly vital role in driving innovation and shaping the future of investment banking.

FAQ Summary: Best Crm For Investment Bankers

What are the key benefits of a CRM for investment bankers?

A CRM system for investment bankers offers numerous benefits, including centralized client data, streamlined deal tracking, enhanced collaboration, improved productivity, and data-driven insights for informed decision-making.

How to choose the right CRM for investment bankers?

Choosing the right CRM involves evaluating features such as contact management, deal tracking, document management, integration capabilities, and vendor reputation. It’s crucial to align the CRM’s capabilities with the specific needs and goals of the investment banking firm.

What are the best practices for implementing a CRM for investment bankers?

Successful CRM implementation requires a well-defined strategy, data migration planning, user training, ongoing maintenance, and regular performance reviews. It’s essential to ensure data accuracy, user adoption, and continuous optimization.