The best CRM for life insurance agents empowers agents to streamline workflows, build strong customer relationships, and achieve unparalleled success. With its comprehensive features and tailored capabilities, a CRM serves as an indispensable tool, transforming the way agents manage their daily operations and engage with clients.

By harnessing the power of a CRM, life insurance agents gain a competitive edge, maximizing their productivity, enhancing customer satisfaction, and driving exceptional results. Let’s delve into the essential elements of a CRM and explore how it can revolutionize your insurance practice.

Key Features to Consider

Essential Features of a CRM for Life Insurance Agents

A robust CRM tailored specifically for life insurance agents should encompass a comprehensive suite of features designed to enhance productivity and streamline workflows. These essential features include:

- Lead Management:Effective lead management capabilities are crucial for capturing, qualifying, and nurturing potential clients. Look for a CRM that offers tools for lead generation, lead scoring, and lead tracking to help agents prioritize and follow up with the most promising prospects.

- Contact Management:A centralized contact management system is essential for organizing and maintaining relationships with clients and prospects. The CRM should allow agents to store detailed contact information, track interactions, and segment contacts based on demographics, interests, and other criteria.

- Policy Administration:Policy administration features are vital for managing the lifecycle of insurance policies. The CRM should provide tools for policy issuance, premium collection, and claims processing. By integrating policy administration into the CRM, agents can streamline their workflows and improve the accuracy and efficiency of policy management.

Capabilities to Enhance Agent Productivity

In addition to these essential features, a CRM for life insurance agents should also include capabilities that enhance productivity and streamline workflows. These capabilities include:

- Calendar and Appointment Scheduling:A built-in calendar and appointment scheduling system allows agents to easily manage their appointments, set reminders, and track client interactions. This helps them stay organized and avoid double-booking.

- Email Integration:Email integration enables agents to send and receive emails directly from the CRM. This eliminates the need to switch between multiple applications and saves time by centralizing all client communication in one place.

- Document Management:A document management system allows agents to store and organize important documents, such as policy contracts, quotes, and marketing materials. This makes it easy for agents to access and share documents with clients and colleagues.

Examples of How Features Streamline Workflows

By leveraging the features and capabilities of a tailored CRM, life insurance agents can significantly streamline their workflows and improve efficiency. For example, the lead management features can help agents identify and prioritize high-potential leads, saving time and effort in pursuing unqualified prospects.

The contact management system provides a centralized repository for all client information, making it easy for agents to stay organized and build strong relationships. Policy administration capabilities automate policy issuance and claims processing, reducing the risk of errors and improving the overall efficiency of policy management.

Industry-Specific Integrations

For life insurance agents, seamless integration with other software is crucial for streamlining processes and enhancing productivity.

Integrations with quoting engines, underwriting systems, and e-signature tools empower CRMs to offer a comprehensive solution tailored to the industry’s specific needs.

Quoting Engines

- Directly access real-time quotes from multiple carriers, eliminating the need for manual data entry.

- Generate accurate and personalized quotes, saving time and improving customer satisfaction.

- Easily compare plans and premiums, enabling agents to present the best options to clients.

Underwriting Systems

- Automate the underwriting process by seamlessly sharing client data with underwriting systems.

- Accelerate policy issuance by reducing manual tasks and eliminating errors.

- Provide agents with real-time updates on underwriting status, enhancing transparency and communication.

E-Signature Tools

- Enable clients to securely sign contracts and documents electronically, eliminating the need for physical signatures.

- Streamline the application process, saving time and increasing efficiency.

- Provide a convenient and modern experience for clients, enhancing their satisfaction.

Customer Relationship Management

Customer Relationship Management (CRM) is crucial for life insurance agents to effectively build and nurture relationships with clients. A CRM system provides a centralized platform to manage all customer interactions, track appointments, and tailor communications, ultimately enhancing customer satisfaction and policy retention.

Tracking Interactions

CRMs allow agents to record and track every interaction with clients, including phone calls, emails, meetings, and notes. This comprehensive history provides valuable insights into customer preferences, concerns, and touchpoints, enabling agents to tailor their approach accordingly.

Managing Appointments

Efficient appointment management is vital for life insurance agents. CRMs offer calendar integration, automated reminders, and scheduling tools that streamline the process of setting up, rescheduling, and confirming appointments. By optimizing their time and avoiding missed appointments, agents can demonstrate professionalism and enhance customer satisfaction.

Personalized Communication

CRMs empower agents to segment their client base and deliver personalized communication. Based on customer data and interaction history, agents can create targeted email campaigns, send customized newsletters, and provide tailored recommendations. This personalized approach fosters stronger relationships and increases the likelihood of policy retention.

Reporting and Analytics: Best Crm For Life Insurance Agents

Effective reporting and analytics are essential for life insurance agents to monitor their performance, track key metrics, and make data-driven decisions.

A robust CRM system provides agents with comprehensive reporting capabilities that enable them to:

Tracking Performance

- Monitor sales pipelines and conversion rates

- Track individual and team performance

- Identify areas for improvement and optimization

Identifying Sales Opportunities

- Analyze customer data to identify potential leads

- Segment prospects based on demographics, interests, and needs

- Create targeted marketing campaigns to maximize conversions

Making Informed Decisions

- Generate reports on key performance indicators (KPIs)

- Analyze data to understand market trends and customer behavior

- Make informed decisions about product offerings, pricing strategies, and sales processes

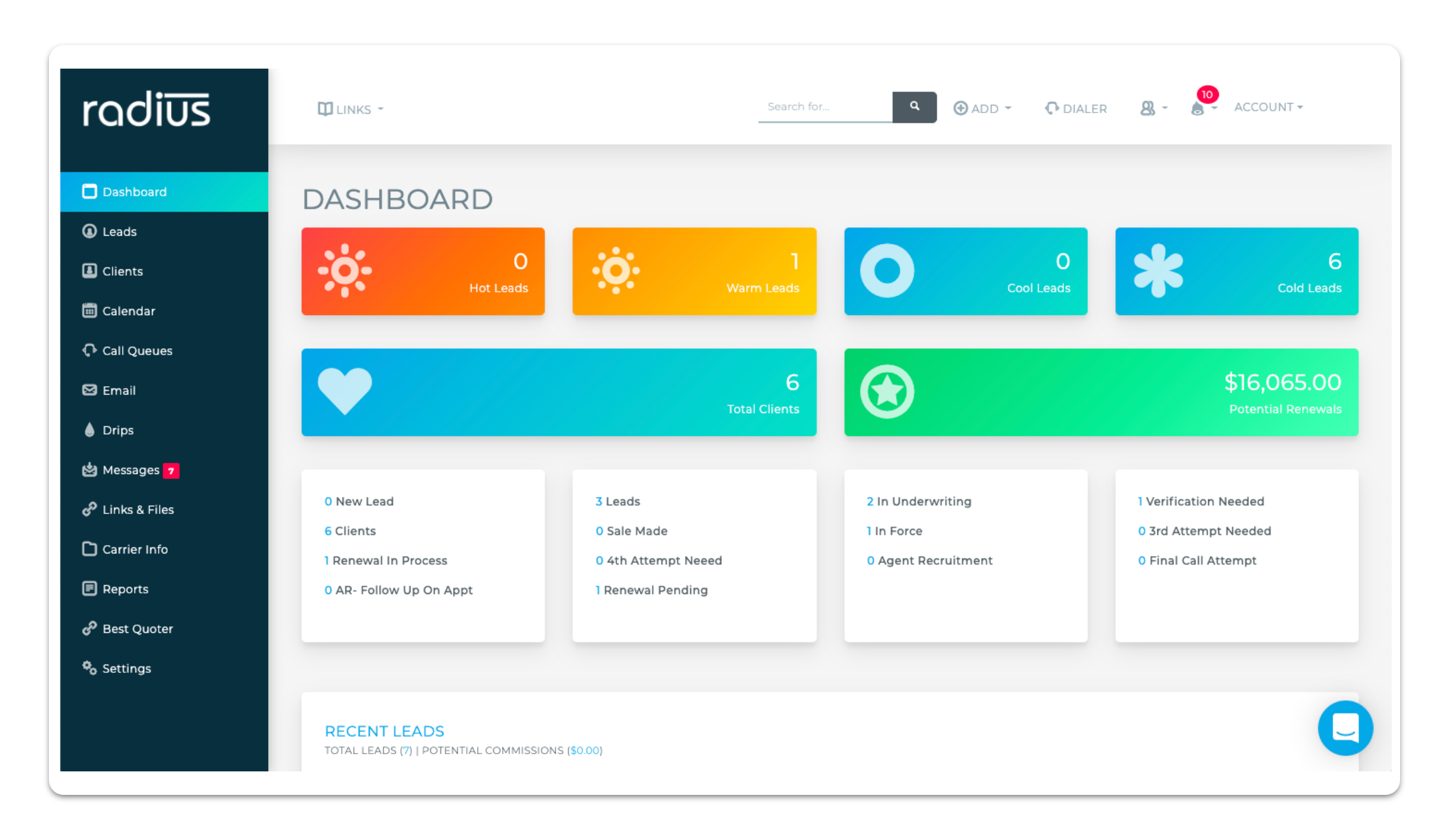

Examples of Valuable Reports and Dashboards

- Sales Pipeline Report: Tracks the progress of sales opportunities through each stage of the pipeline

- Conversion Rate Dashboard: Provides an overview of the percentage of leads that convert into customers

- Customer Lifetime Value Report: Estimates the total revenue generated by a customer over their lifetime

Mobile Accessibility

Life insurance agents are often on the go, meeting with clients and attending industry events. Having a CRM that is accessible on mobile devices is essential for these agents to stay productive and provide excellent customer service.

A mobile-accessible CRM allows agents to access their customer data, manage their schedules, and track their progress from anywhere. This can save them time and help them close more deals.

Features and Capabilities

When choosing a CRM for mobile use, agents should look for the following features and capabilities:

- A user-friendly interface that is easy to navigate on a mobile device

- The ability to access all of the same data and features that are available on the desktop version of the CRM

- Offline access so that agents can continue to work even when they don’t have an internet connection

- Push notifications to keep agents informed of important updates

- GPS tracking to help agents find their way to client meetings

Benefits

Mobile access to a CRM can provide a number of benefits for life insurance agents, including:

- Increased productivity: Agents can save time by accessing their CRM on the go, which allows them to close more deals.

- Improved customer service: Agents can provide better customer service by having access to their customer data and history at all times.

- Increased collaboration: Agents can collaborate more easily with colleagues and clients by sharing data and documents through the CRM.

Security and Compliance

Life insurance agents are responsible for handling sensitive client data, including financial information and personal details. To protect this data, they must comply with strict security and compliance requirements. A CRM can help agents maintain data privacy and comply with industry regulations by providing robust security measures and compliance features.

Security Measures, Best crm for life insurance agents

* Encryption:CRMs use encryption to protect data both in transit and at rest, ensuring that unauthorized individuals cannot access it.

Multi-factor Authentication

This requires users to provide multiple forms of identification before accessing the CRM, adding an extra layer of security.

Role-Based Access Control

CRMs allow administrators to set different levels of access for users, ensuring that only authorized personnel can view or modify sensitive data.

Compliance Features

* GDPR Compliance:CRMs can help agents comply with the General Data Protection Regulation (GDPR) by providing features for managing consent, data deletion, and breach notification.

HIPAA Compliance

For agents handling health insurance, CRMs can assist with compliance with the Health Insurance Portability and Accountability Act (HIPAA) by providing secure storage and transmission of protected health information.

SOC 2 Certification

This certification demonstrates that a CRM has met industry-recognized security and privacy standards, giving agents confidence in its compliance.

Summary

In conclusion, a CRM is not merely a software tool; it’s a strategic investment that empowers life insurance agents to achieve their full potential. By embracing a CRM, agents can optimize their workflows, foster lasting customer relationships, and make data-driven decisions that lead to exceptional outcomes.

As the insurance industry continues to evolve, the role of a CRM will only become more critical, enabling agents to stay ahead of the curve and deliver unparalleled service to their clients.

Essential FAQs

What are the key features to consider when choosing a CRM for life insurance agents?

Essential features include lead management, contact management, policy administration, quoting engine integrations, underwriting system integrations, e-signature capabilities, personalized communication tools, and robust reporting and analytics.

How does a CRM help life insurance agents build and manage customer relationships?

A CRM provides a centralized platform for tracking interactions, managing appointments, and delivering personalized communication, enabling agents to nurture relationships and provide exceptional customer service.

What are the benefits of mobile accessibility in a CRM for life insurance agents?

Mobile accessibility allows agents to access customer information, manage tasks, and close deals on the go, increasing productivity and improving customer engagement.