For many borrowers, private student loans can be both a blessing and a burden. While they provide access to necessary education funding beyond federal aid limits, they often come with higher interest rates and fewer borrower protections. For individuals with multiple private student loans, consolidation can offer a path to financial simplicity and lower payments. However, if you have bad credit, the process becomes more challenging. This article will guide you through the complexities of consolidating private student loans with bad credit, examining the options, risks, benefits, and strategies to improve your financial situation.

Understanding Private Student Loan Consolidation

. What Is Private Student Loan Consolidation?

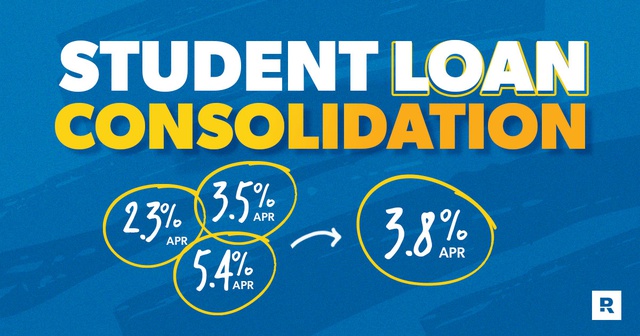

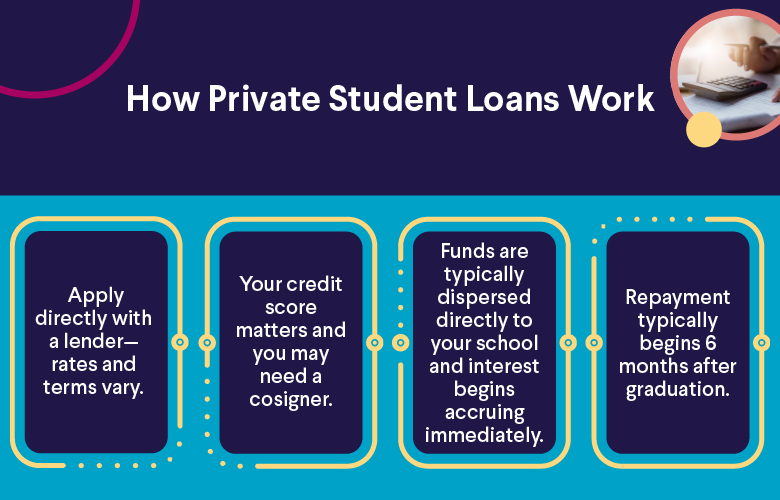

Private student loan consolidation involves combining multiple private student loans into a single new loan with one monthly payment. Unlike federal loan consolidation, which is offered by the U.S. Department of Education for federal student loans, private consolidation—also known as student loan refinancing—is provided by private lenders such as banks, credit unions, and online lending companies.

. How Does It Work?

When you consolidate or refinance private student loans, a lender pays off your existing loans and issues a new loan with new terms. These new terms might include a different interest rate, repayment period, or payment schedule. Ideally, the new loan has a lower interest rate or more favorable repayment terms that save you money and simplify your finances.

Challenges of Consolidating with Bad Credit

. What Is Considered Bad Credit?

Credit scores typically range from 300 to 850. While each lender has its own criteria, a credit score below 600 is generally considered poor. A score between 600 and 669 is considered fair, while 670 and above is usually regarded as good to excellent. Bad credit can result from missed payments, high debt levels, bankruptcies, or defaults.

. Why Bad Credit Is a Barrier

Private lenders heavily rely on credit scores and financial history when evaluating loan applications. Bad credit signals a higher risk for the lender, making it more difficult for you to qualify for consolidation. If approved, you may receive a higher interest rate than someone with excellent credit, which can negate some of the benefits of refinancing.

. Income and Debt-to-Income Ratio

Aside from your credit score, lenders also assess your income and debt-to-income (DTI) ratio. A high DTI—meaning you spend a large portion of your income on debt payments—can further reduce your chances of approval. Lenders want to see that you have a stable income and can comfortably manage the new loan payments.

Reasons to Consolidate Private Student Loans with Bad Credit

Even with bad credit, consolidation may still offer advantages in specific situations. Here are some reasons you might consider it:

. Simplify Repayment

Managing multiple student loans from different lenders can be confusing and stressful. Consolidation streamlines repayment by combining all loans into a single monthly payment, reducing the chances of missed payments and helping you stay organized.

. Access Lower Monthly Payments

Some lenders allow extended repayment terms, which can reduce your monthly payments. While this may increase the total interest paid over time, it can provide immediate relief if you are struggling financially.

. Fixed Interest Rate

If your current loans have variable interest rates, consolidating into a fixed-rate loan may provide stability and protection from future interest rate hikes.

. Improve Credit Over Time

Making consistent, on-time payments on a new consolidation loan can improve your credit score over time, opening up better financial opportunities in the future.

Options for Consolidating Private Student Loans with Bad Credit

While bad credit makes the process more difficult, there are still options available to consolidate your loans:

. Apply with a Creditworthy Cosigner

One of the most effective ways to consolidate private student loans with bad credit is to apply with a cosigner. A cosigner is someone with good credit—often a parent, spouse, or trusted friend—who agrees to be legally responsible for the loan if you fail to repay it.

Lenders will base the interest rate and approval decision largely on the cosigner’s credit profile. This can significantly improve your chances of approval and help you secure better terms. However, it’s important to understand that your cosigner is taking on risk, and missed payments can damage their credit.

. Use a Lender That Accepts Lower Credit Scores

Some lenders specialize in working with borrowers who have lower credit scores. These lenders may offer higher interest rates or require stricter income verification, but they may still approve your consolidation application. Examples include online lending platforms and credit unions with flexible underwriting criteria.

. Improve Your Credit Before Applying

If possible, delay the application process and take time to improve your credit. This may involve:

-

Paying down credit card debt

-

Making all payments on time

-

Disputing errors on your credit report

-

Avoiding new hard credit inquiries

Even a modest increase in your credit score can make a difference in the interest rate you’re offered.

. Consider Alternative Repayment Plans

If consolidation is not an option, look into alternative repayment plans offered by your current lenders. Some private lenders may be willing to modify your payment terms or provide temporary forbearance or deferment options during financial hardship.

Steps to Consolidate Private Student Loans with Bad Credit

Step 1: Review Your Credit Report

Start by checking your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. Look for inaccuracies, outdated information, or fraudulent activity. Dispute any errors that could negatively impact your score.

Step 2: Evaluate Your Loan Portfolio

Make a list of all your private student loans, including:

-

Outstanding balance

-

Interest rate

-

Monthly payment

-

Lender name

This helps you determine how much you owe and what consolidation options might be beneficial.

Step 3: Compare Lenders

Research lenders that offer private student loan consolidation. Compare interest rates, loan terms, fees, cosigner requirements, and borrower reviews. Focus on those that work with borrowers with bad credit or allow cosigners.

Step 4: Prequalify if Possible

Many lenders offer prequalification tools that perform a soft credit check, which doesn’t affect your credit score. This allows you to see your potential interest rate and approval odds before officially applying.

Step 5: Apply for Consolidation

If you find a lender that meets your needs, complete the application. Be prepared to submit documentation such as:

-

Proof of income (pay stubs, tax returns)

-

Proof of identity (ID, Social Security number)

-

Information on current student loans

If you’re using a cosigner, they will also need to provide similar documentation.

Step 6: Review and Sign the Agreement

If approved, review the terms of the new loan carefully. Pay attention to:

-

Interest rate (fixed or variable)

-

Loan term (e.g., 5, 10, or 15 years)

-

Fees (origination, prepayment penalties)

-

Monthly payment amount

Once you’re satisfied, sign the loan agreement. The new lender will then pay off your existing loans and begin servicing your new consolidated loan.

Risks and Considerations

. Higher Interest Rates

With bad credit, the interest rate on your new consolidated loan may be higher than your existing loans. This can increase the total cost of the loan over time.

. Loss of Borrower Benefits

Some private lenders offer benefits like interest rate discounts for autopay or temporary hardship assistance. Consolidation may eliminate these benefits, depending on your new lender.

. Risk to Cosigners

If you use a cosigner, they are legally responsible for the debt. If you default, their credit will be affected, and they may be required to repay the loan.

. Extended Repayment = More Interest

Lower monthly payments achieved through extended loan terms may result in more interest paid over the life of the loan. Always calculate the total cost before committing.

How to Improve Your Credit Score

If you’re not in a rush to consolidate, taking steps to improve your credit can lead to better options:

. Make Timely Payments

Payment history is the most significant factor in your credit score. Always pay your bills on time.

. Reduce Credit Utilization

Keep credit card balances low relative to your credit limit. Aim for a utilization rate below 30%.

. Keep Old Accounts Open

Length of credit history matters. Avoid closing old credit accounts unless necessary.

. Limit New Credit Applications

Multiple hard inquiries can lower your score. Only apply for new credit when necessary.

. Use a Credit Builder Loan or Secured Credit Card

These tools are designed to help individuals with bad credit rebuild their credit profile through responsible borrowing and repayment.

Alternatives to Consolidation

If consolidation isn’t feasible due to bad credit, consider the following alternatives:

. Income-Driven Repayment Plans (Federal Loans Only)

While not available for private loans, federal loans offer income-driven repayment plans that adjust payments based on your income. If you have both federal and private loans, you can refinance only the private ones.

. Deferment or Forbearance

Some private lenders offer deferment or forbearance during financial hardship. This allows temporary relief, but interest may continue to accrue.

. Loan Modification

In rare cases, lenders may agree to modify loan terms. This could include reducing the interest rate or extending the repayment period.

. Credit Counseling

Nonprofit credit counseling agencies can help you create a debt management plan. While they can’t consolidate student loans directly, they can help you manage your overall financial obligations.

Real-Life Case Studies

Case Study l : Jessica with Bad Credit and a Cosigner

Jessica had $45,000 in private student loans and a credit score of 580. She applied for consolidation with a cosigner—her mother, who had a credit score of 750. She was approved for a new loan with a lower interest rate, saving $100/month in payments and $8,000 over the loan term.

Case Study ll : Michael Without a Cosigner

Michael had a credit score of 620 and couldn’t find a cosigner. He applied through an online lender that accepts borrowers with fair credit. He was approved but received a 9.5% interest rate—higher than his previous average of 8.2%. He declined the offer and chose to wait six months while working to improve his credit.

Case Study lll : Sarah Uses Deferment

Sarah was laid off and couldn’t make payments. Her lender offered a 6-month deferment. Although interest accrued, she avoided late fees and damage to her credit, giving her time to find a new job.

Final Thoughts

Consolidating private student loans with bad credit is not easy, but it is not impossible. By understanding the requirements, evaluating your financial situation, and taking proactive steps to improve your credit or find a cosigner, you can access better loan terms and reduce financial stress.

While consolidation can simplify your repayment process and offer potential savings, it’s not the right choice for everyone. Carefully weigh the pros and cons, explore all your options, and choose a path that aligns with your long-term financial goals.