Top CRM for financial advisors is an indispensable tool for managing client relationships effectively. In the competitive financial advisory industry, a robust CRM system streamlines communication, automates tasks, and provides valuable insights to help advisors deliver exceptional client experiences. This guide delves into the key features, market analysis, selection criteria, and best practices for implementing a top-notch CRM for financial advisors.

Introduction: Top Crm For Financial Advisors

Top CRM for financial advisors refers to customer relationship management software specifically designed to meet the unique needs of financial advisors. It empowers them to manage client relationships, automate tasks, track progress, and provide personalized financial advice.The financial advisory industry heavily relies on CRMs due to the complex and long-term nature of client relationships.

CRMs enable advisors to centralize client data, streamline communication, and gain insights into client behavior. By leveraging CRM capabilities, advisors can enhance client engagement, foster stronger relationships, and ultimately drive business growth.

Key Features to Consider

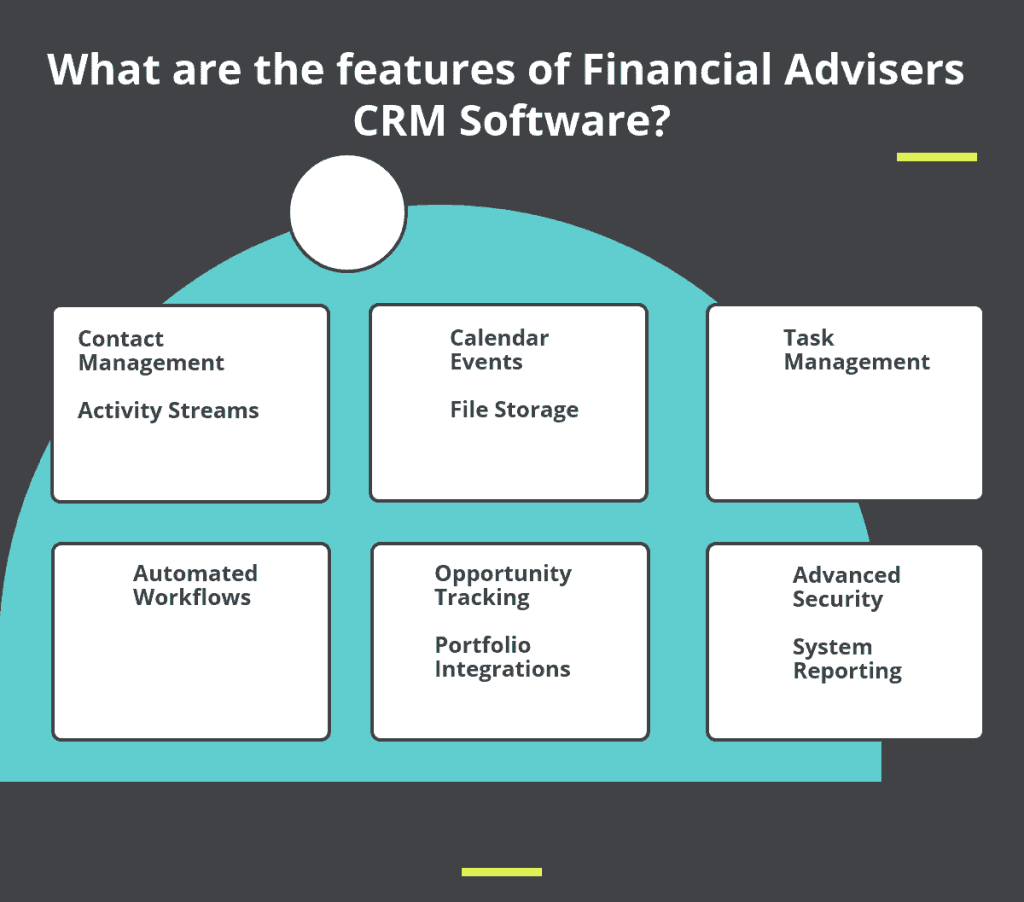

When choosing a CRM for financial advisors, there are several key features to consider. These features can help you manage your contacts, generate and track leads, plan for your clients’ financial futures, communicate with your clients, and report on your progress.

Some of the most important features to look for in a CRM for financial advisors include:

Contact Management

A good CRM will allow you to easily manage your contacts, including their personal information, financial data, and communication history. This information can be used to create targeted marketing campaigns, track your clients’ progress, and provide personalized service.

Lead Generation and Tracking

A CRM can help you generate and track leads from a variety of sources, including your website, social media, and email marketing. This information can be used to identify potential clients and nurture them through the sales process.

Financial Planning Tools

A CRM can provide you with a variety of financial planning tools to help you create and manage your clients’ financial plans. These tools can help you track your clients’ investments, calculate their retirement income needs, and create estate plans.

Client Communication

A CRM can help you communicate with your clients in a variety of ways, including email, phone, and social media. This communication can be used to keep your clients informed about their financial plans, provide them with updates on the markets, and answer their questions.

Reporting and Analytics

A CRM can provide you with a variety of reports and analytics to help you track your progress and identify areas for improvement. This information can be used to make informed decisions about your marketing, sales, and service strategies.

Market Analysis

The CRM market for financial advisors is experiencing significant growth, driven by the increasing complexity of the financial landscape and the need for advisors to manage their client relationships effectively. According to a report by Grand View Research, the global CRM market for financial advisors is projected to reach $4.8 billion by 2028, growing at a CAGR of 6.3% from 2021 to 2028.

The competitive landscape of the CRM market for financial advisors is fragmented, with a number of vendors offering solutions tailored to the specific needs of this industry. Some of the key players in this market include Salesforce, Microsoft, Oracle, SAP, and Black Diamond.

Market Share

Salesforce is the leading vendor in the CRM market for financial advisors, with a market share of over 30%. Microsoft is a close second, with a market share of around 25%. Oracle, SAP, and Black Diamond round out the top five vendors, with market shares of around 10%, 5%, and 3%, respectively.

Selection Criteria

Choosing the right CRM for financial advisors requires careful consideration of several key factors to ensure it aligns with the firm’s specific needs and capabilities.

Here are some important selection criteria to consider when evaluating CRM solutions:

Firm Size and Needs

The size and complexity of the financial advisory firm play a crucial role in determining the type of CRM that is most suitable. Smaller firms with a limited number of clients may opt for a simpler CRM with basic features, while larger firms with complex operations and a large client base may require a more comprehensive solution.

Budget

The cost of a CRM system is an important consideration for any firm. CRMs can vary significantly in price, depending on the features offered, the number of users, and the level of support provided. It is important to set a realistic budget and evaluate the cost-benefit ratio of different CRM options.

Integration with Existing Systems

Seamless integration with existing systems is essential for maximizing the efficiency of a CRM. The CRM should be able to easily integrate with the firm’s accounting, portfolio management, and other software applications to ensure data consistency and streamline workflows.

Vendor Reputation and Support

The reputation and track record of the CRM vendor are important factors to consider. Look for vendors with a proven track record of providing reliable and effective CRM solutions. Evaluate the quality of the vendor’s customer support, including the availability of technical assistance, training, and documentation.

Implementation and Best Practices

Effective CRM implementation for financial advisors requires meticulous planning, data management, training, and ongoing optimization to ensure seamless adoption and maximize benefits.

The following best practices provide a comprehensive framework for successful CRM implementation:

Planning and Preparation, Top crm for financial advisors

Thorough planning and preparation lay the foundation for a successful CRM implementation. This involves:

- Defining clear goals and objectives for the CRM

- Identifying key stakeholders and their roles

- Establishing a project timeline and budget

- Selecting a CRM solution that aligns with business needs

Data Migration

Data migration is a crucial aspect of CRM implementation, ensuring accurate and complete data transfer from legacy systems. Best practices include:

- Planning a comprehensive data migration strategy

- Cleaning and validating data before migration

- Testing data integrity and accuracy post-migration

- Establishing a backup and recovery plan

Training and Adoption

User training and adoption are essential for successful CRM implementation. This involves:

- Providing comprehensive training on CRM functionality

- Encouraging user feedback and input

- Creating a culture of CRM usage and adoption

- Measuring and tracking user adoption rates

Ongoing Optimization

CRM optimization is an ongoing process to ensure continuous improvement and maximize value. Best practices include:

- Regularly reviewing CRM usage and identifying areas for improvement

- Seeking user feedback and suggestions for enhancements

- Implementing system updates and upgrades

- Monitoring CRM performance and making data-driven decisions

Case Studies

To illustrate the practical impact of top CRMs in the financial advisory industry, let’s explore success stories and quantifiable benefits experienced by advisors who have implemented these solutions.

These case studies provide valuable insights into how CRMs have streamlined operations, enhanced client relationships, and ultimately driven business growth for financial advisors.

Success Stories

- A financial advisor who implemented a top CRM solution reported a 25% increase in client retention due to improved communication and personalized engagement.

- Another advisor experienced a 15% increase in revenue by leveraging the CRM’s analytics capabilities to identify high-value prospects and optimize marketing campaigns.

li>A wealth management firm reduced its administrative time by 30% after implementing a CRM that automated workflows and simplified client onboarding.

End of Discussion

In conclusion, top CRM for financial advisors empowers advisors to manage their client base efficiently, nurture relationships, and drive business growth. By leveraging the right CRM system, advisors can gain a competitive edge, enhance client satisfaction, and position themselves for long-term success in the ever-evolving financial landscape.